Fridays, especially the ones when we get paid are the most wonderful days throughout the year; but what we do with your paychecks matters the most! It's always a good idea to rethink, restrategize, regroup, & reform our lives and our plans.

Taxes

The first thing we probably do is, withhold a large chunk of our salary for the taxes. This is called Payroll Tax Withholding that is done by your employer before the paycheck is printed for you or direct-deposited to your bank account. The employer then remits the withheld taxes to IRS or relevant department/agency in your country.

The first thing we must do is, we should reevaluate our W-4s or any other forms used in your respective country. W-4 form and the likes of it allow you to adjust how much amount you want to be withheld.

In form W-4 you can use 0 on Line 5 to indicate that you want the maximum amount to be taken out as withholding. The higher the number, the less the taxes. Alternatively, you can choose to not withhold any tax.

Why would you want to withhold taxes from your paycheck every other week? It's like lending money to the Government for free when you are supposed to pay taxes at the end of the year (even 16 months later).

Let us take an example and see how much Loss are we actually taking by paying this tax before time?

Mr. Hive takes pride in his work and is paid handsomely every second week.

Every 2 weeks, he gets a hefty check of $5,000 and he is paying his withholding taxes very generously.

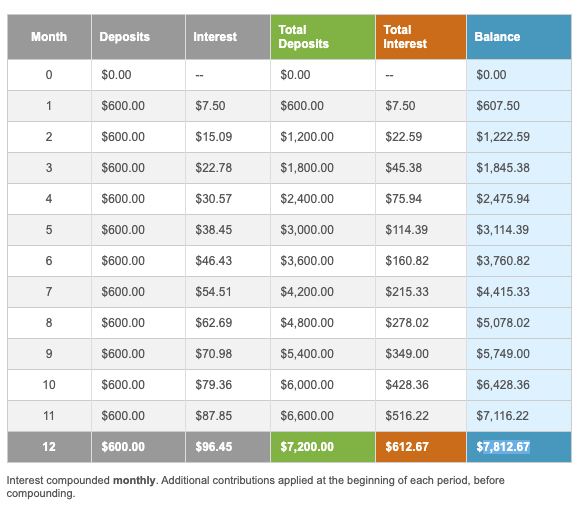

| Tax Type | Tax % | $$ |

|---|---|---|

| Federal Income Tax | 6% | $300 |

| Social Security Tax | 6% | $300 |

| Medicare | 1.5% | $75 |

Let's assume Mr. Hive does not pay the withholding tax of $600 to IRS every month for a maximum of 16 months (You can file your taxes in April which leaves you with 16 months from January last year).

Mr. Hive decides to put $300 every two weeks ($600/month) in a secure investment i.e. SPY that gives an average of 15% returns every year or 1.25% every month.

With the amount of $7200 not paid to IRS as withholding tax, Mr. Hive could easily make $612.67 Profit every year.

If Mr. Hive does not desire to pay taxes yet until April and prolongs the investment for 4 more months.

Mr. Hive could save $1086 every cycle of tax returns by not paying the Withholding Taxes every month.

Let's take this one step further

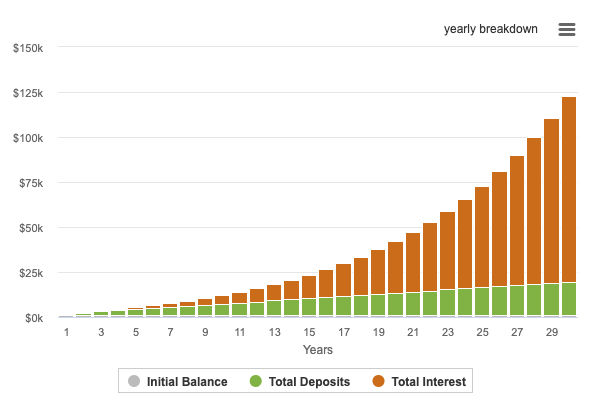

Let's assume Mr. Hive saves $612.67 and does not withdraw it every year. He withdraws $7200 which he invested to pay the taxes in his tax returns every year.

Mr. Hive saves a whooping ~$125000.00 in 30 years by Not Paying Taxes every month and Choosing to pay the taxes at the end of the year.

Again, this example is just a simple example of Investing in SPY ETF. What if Mr. Hive Chose to invest in a dividend-paying stock? What if he put 25% of that money into SPY, 25% into Mcdonald's stock, 25% into ARKK, and another 25% into Cryptocurrency?

Please support this write-up to support the economy of Project-Hive. 45% of the earnings from this will go to Project-Hope. 5% of earnings will go to a new user who needs some support getting onboarded.