This has been a wonderful week in the stock market as we have seen some recovery from the last 3 weeks of carnage. I know not many here are fans of USD and Wall Street but I find it worth my time to invest some in Stock Market apart from Cryptocurrencies.

We should never put all eggs in one basket. It applies to sources of Income too not just how many stocks or cryptocurrencies you are invested in.

Last year I made over 50% gains doing the same thing, and this year until the end of February 2021, I had gained over 30% in YTD. The first target this year is to beat last year's gains and the second target is to catch up with ARKK (which made over 120% last year).

I will cut to the chase, not keep you busy with more text.

Stocks

I manage 3 Stock Portfolios

- Major Portfolio (long-term)

- Small Portfolio (short-term)

- Penny Stocks Portfolio (short-term)

I would talk about Major Portfolio here, the other two are doing great but do not have much capital in them.

1. Major Portfolio with long-term investment

a. Stock Performance Comparison

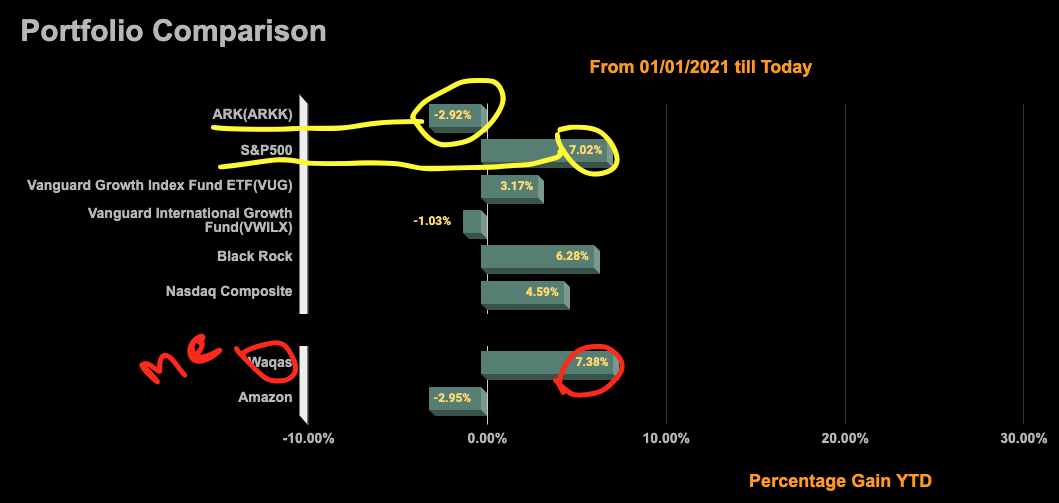

Portfolio Comparison YTD - Thursday - April 1, 2021

After a month of trial, I finally have crossed S&P and I am not bragging about it because I know it very well may be temporary. S&P Just hit All-Time Highs today and might be a bullish signal for many, but I am into growth stocks more and I am hoping some of that money will change hands in days to come.

So far, I have 7.38% Gains this year (dropped from the highs of 40% in February)

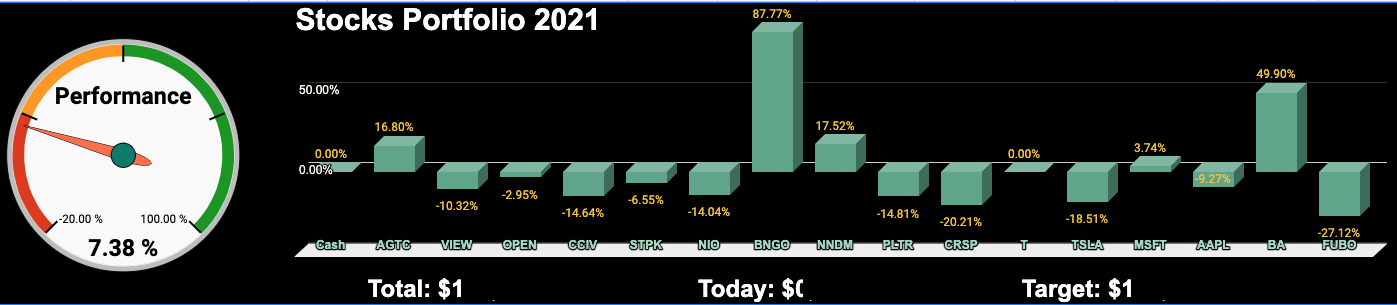

b. Stock Portfolio

The portfolio consists of multiple sectors including Healthcare (growth), Technology (blue chip and growth), Travel & Aerospace, Electronics & Automobile(EV), etc.

Following is the list of holdings and the percentage of my total investment in each.

Portfolio YTD - Thursday - April 1, 2021

With gains of under 2.84% in the last two days, I am up by 7.38% YTD.

Major Winners include BNGO, BA, NNDM, and AGTC.

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| FUBO | Fubotv Inc | 9.00% | 9.01% | 1.54% |

| BA | Boeing Co | 21.00% | 20.31% | -0.64% |

| AAPL | Apple Inc. | 6% | 6.32% | 0.70% |

| MSFT | Microsoft Corp. | 6.00% | 5.48% | 2.79% |

| TSLA | Tesla Inc | 6.00% | 6.38% | -0.93% |

| CRSP | Crispr Th. AG | 12.00% | 11.98% | -2.00% |

| PLTR | Palantir Tech. Inc. | 6.00% | 5.56% | -0.94% |

| NNDM | Nano Dimension Ltd. | 3.00% | 2.67% | -3.03% |

| BNGO | BioNano Gen. Inc. | 1.00% | 1.26% | -3.09% |

| NIO | Nio Inc | 8.00% | 7.96% | 1.74% |

| STPK | Star Peak Energy | 4.00% | 4.33% | 1.16% |

| CCIV | Applied Genetic Tech. Co | 7.00% | 6.68% | 2.59% |

| OPEN | Opendoor | 4.00% | 4.37% | 2.64% |

| VIEW | View Inc. | 2.00% | 2.59% | 9.19% |

| AGTC | Applied Genetic Tech. Co | 5.00% | 4.69% | 3.16% |

a. Crytpcurrencies

I manage 2 different portfolios in Cryptocurrencies, just based on exchanges.

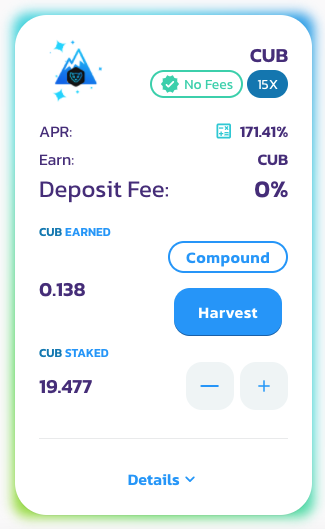

I do not trade in HIVE and STEEM, I just have them in my respective platforms as power and I am staking Cubs through Farms and Dens in cubdefi.com

Portfolio 1

With gains of 1906% YTD

| Ticker | Name | Target Inv. | Current Inv. | 24HR Gain |

|---|---|---|---|---|

| ADA | Cardano | 35.00% | 28.73% | 0.23% |

| SC | Sia Coin | 25.00% | 29.80% | 11.34% |

| RDD | REDD Coin | 10.00% | 17.99% | 0.63% |

| XVG | Verge | 10.00% | 12.51% | -0.75% |

| XLM | Steller Lumens | 10.00% | 6.76% | 5.51% |

| XRP | Ripple | 10.00% | 4.21% | -1.42% |

b. Portfolio 2

With gains of 54% YTD

| Ticker | Name | Target Inv. | Current Inv. | 24HR Gain |

|---|---|---|---|---|

| BAT | Basic Attention Token | 35.00% | 36.98% | -2.76% |

| XLM | Steller Lumens | 30% | 35.07% | 5.62% |

| ADA | Cardano | 15.00% | 16.19% | 0.38% |

| XRP | Ripple | 20.00% | 11.76% | -1.42% |

c. Cubs and Staking

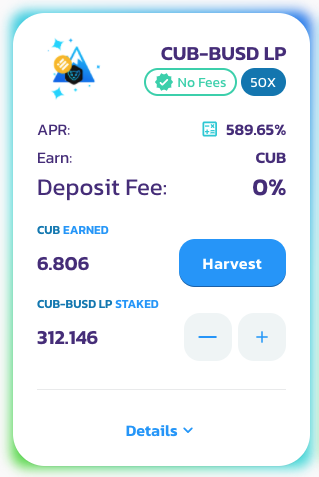

I Staked in a Liquidity Pool of CUB-BUSD (LP), around 312 Cubs and BUSD (~$1100).

| Farm CUB-BUSD LP | DEN CUB |

|---|---|

|  |

| So, with unharvested 6.806 and Harvested 17 Cubs, It's around ~25 Cubs in 4 Days. An average of 6 / day. | Not much farmed here, but I am compounding my Farm's cubs here... |

25 Cubs at $4.647 (current price) = $116.175 in 4 Days. An average of $29 / Day of passive Income.

Posted Using LeoFinance Beta