As predicted before the start of the week in my other write-up, the market started on Monday with mixed emotions. There were fear and hope in the market. Monday was no good to me, and Tuesday started with all Future markets down and for the first hour of the market, it was horrible.

The market started to stabilize a little bit in the noon after 10:00 AM on Tuesday. It was overall an exciting day as ARKX was launched and as is with every growth stock, the futuristic ETF related to space slipped on the launch day (unlike any other highly hyped stock).

Archegos Capital Management's catastrophic margin disaster also played a huge role in the last 3 days of trading but the Market seemed to have reacted to that news enough and Banks got the most hit from this phenomenon.

Last year I made over 50% gains doing the same thing, and this year until the end of February 2021, I had gained over 30% in YTD. The first target this year is to beat last year's gains and the second target is to catch up with ARKK (which made over 120% last year).

I would like to share my progress and maybe someone finds it helpful or has some suggestions to make.

I manage my stocks in 3 different portfolios,

- Major Portfolio (long-term)

- Small Portfolio (short-term)

- Penny Stocks Portfolio (short-term)

Stocks

Major Portfolio with long-term investment

Stock Performance Comparison

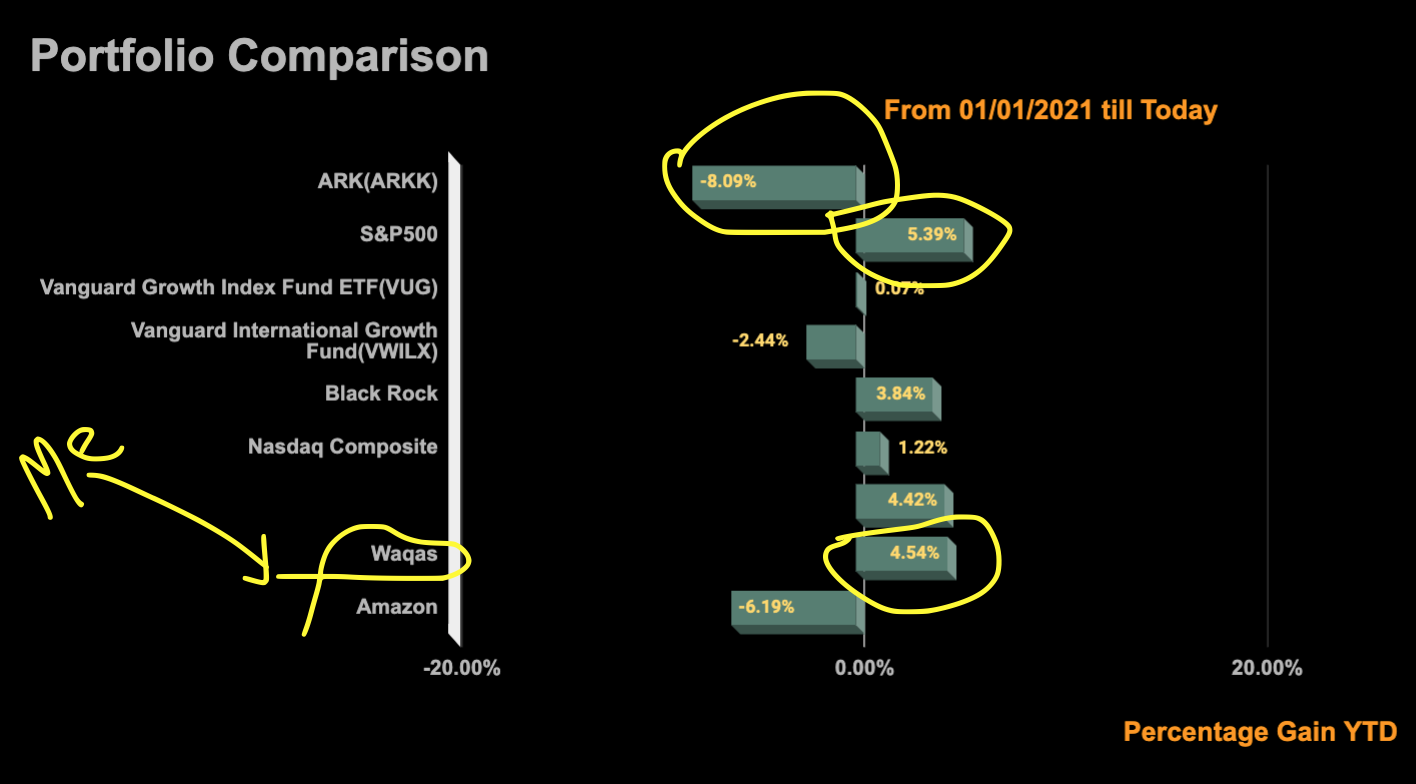

Portfolio Comparison YTD - Tuesday - March 30, 2021

I have put together a comparison mechanism to check my performance Year-To-Date and I am comparing my performance with following

- ARKK (with over 120% gains last year, this year it is around 8.09% down)

- S&P (with 15.76% last year, is so far 5.39% up)

- and others... as you can see in the image above.

I majorly compare myself with S&P, but since ARKK is a new phenomenon, I do try to perform better than that.

This year, I was doing great at 30% up until the end of Feb., but March dealt a striking blow to all my gains, and my gains have shrunk to 4.54% so far this year. I am still doing better than the ARKK, but S&P has more gains this year as of today.

Stock Portfolio

Portfolio YTD - Tuesday - March 30, 2021

With today's gains of over 2.75%, I am up by 4.54% YTD.

Major Winners include BNGO, BA, NNDM, and AGTC.

The portfolio consists of multiple sectors including Healthcare (growth), Technology (blue chip and growth), Travel & Aerospace, Electronics & Automobile(EV), etc.

Following is the list of holdings and the percentage of my total investment in each.

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| FUBO | Fubotv Inc | 9.00% | 8.97% | 3.28% |

| BA | Boeing Co | 21.00% | 20.78% | 0.51% |

| AAPL | Apple Inc. | 6% | 6.33% | -1.23% |

| MSFT | Microsoft Corporation | 6.00% | 5.74% | -1.44% |

| TSLA | Tesla Inc | 6.00% | 6.29% | 3.98% |

| CRSP | Crispr Therapeutics AG | 12.00% | 11.88% | 4.05% |

| PLTR | Palantir Technologies Inc | 5.00% | 5.45% | 1.47% |

| NNDM | Nano Dimension Ltd. | 3.00% | 2.75% | 1.71% |

| BNGO | BioNano Genomics Inc | 1.00% | 1.27% | 5.03% |

| NIO | Nio Inc | 8.00% | 7.74% | 5.74% |

| STPK | Star Peak Energy | 4.00% | 4.55% | 7.18% |

| CCIV | Applied Genetic Technologies Co | 7.00% | 6.79% | 10.12% |

| OPEN | Opendoor | 4.00% | 4.23% | 0.34% |

| VIEW | View Inc. | 3.00% | 2.66% | 2.02% |

| AGTC | Applied Genetic Technologies Co | 5.00% | 4.51% | 2.73% |

Crytpcurrencies

I manage 2 different portfolios in Cryptocurrencies, just based on exchanges.

I do not trade in HIVE and STEEM, I just have them in my respective platforms as power.

Portfolio 1

With gains of 1794% YTD

| Ticker | Name | Target Investment | Current Investment | 24HR Gain |

|---|---|---|---|---|

| ADA | Cardano | 35.00% | 31.26% | 0.58% |

| SC | Sia Coin | 25.00% | 26.29% | 2.55% |

| RDD | REDD Coin | 10.00% | 19.19% | 2.55% |

| XVG | Verge | 10.00% | 12.05% | -3.40% |

| XLM | Steller Lumens | 10.00% | 6.71% | -0.51% |

| XRP | Ripple | 10.00% | 4.50% | 1.08% |

Portfolio 2

With gains of 54.05% YTD

| Ticker | Name | Target Investment | Current Investment | 24HR Gain |

|---|---|---|---|---|

| BAT | Basic Attention Token | 35.00% | 36.78% | 0.08% |

| XLM | Steller Lumens | 30% | 34.49% | -0.87% |

| ADA | Cardano | 15.00% | 16.71% | 0.77% |

| XRP | Ripple | 20.00% | 12.02% | 1.08% |

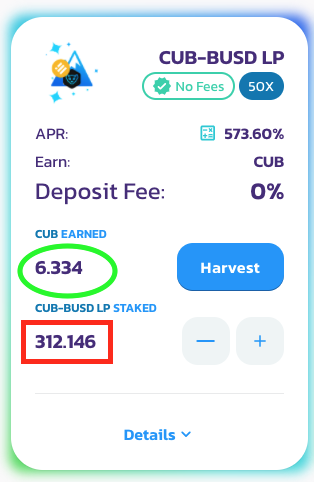

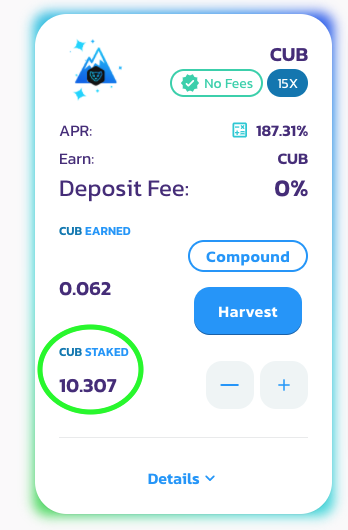

Cubs and Staking

I Staked in a Liquidity Pool of CUB-BUSD (LP), around 312 Cubs and BUSD (~$1100).

So, with unharvested 6.334 and Harvested 10.3 Cubs, It's around ~16 Cubs in 48 hours. With 8 Cubs every 24 hours ($28 value) for an $1100 investment, I don't think it's bad.

16.66 Cubs at $3.57 = $59.4762 in 48 hours is not bad.

Posted Using LeoFinance Beta