Source

SourceThis is Day 2 of my portfolio sharing with the hive community.

The bloodbath that started last week halted today and gave some breathing space to the holders. I do not sell when the markets are going down, I average it out. I buy more of the same stocks to average my losses out and gain a better cost basis for my overall lot.

Last year I made over 50% gains doing the same thing, and this year until the end of February 2021, I had gained over 30% in YTD. The first target this year is to beat last year's gains and the second target is to catch up with ARKK (which made over 120% last year).

I would like to share my progress and maybe someone finds it helpful or has some suggestions to make.

I manage my stocks in 3 different portfolios,

- Major portfolio (long-term)

- Small portfolio (short-term)

- Penny stocks (short-term)

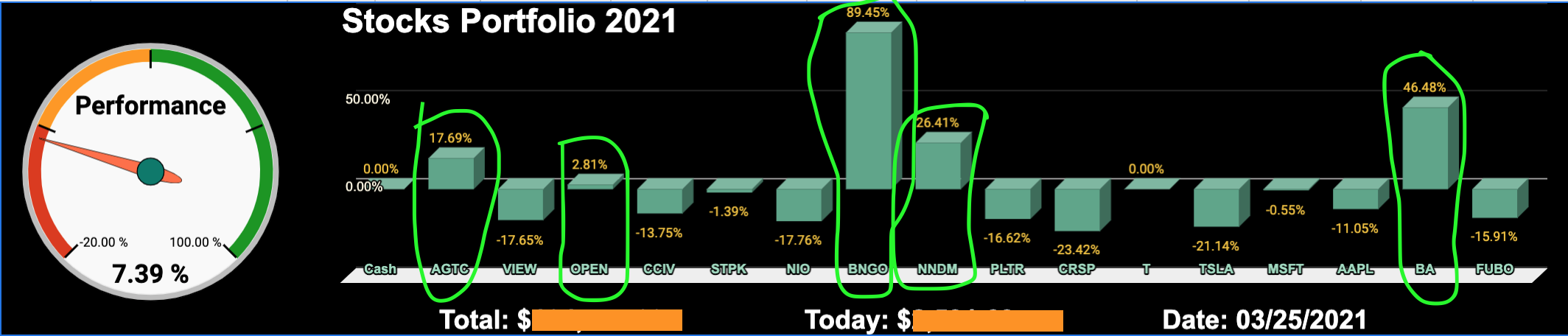

Stocks (Major Portfolio with long-term investment)

Performance Comparison

Portfolio Comparison YTD - Thursday - March 25, 2021

I have put together a comparison mechanism to check my performance Year-to-date and I am comparing my performance with following

- ARKK (with over 120% gains last year, this year it is around 8% down)

- S&P (with 15.76% last year, is so far 3.54% up)

- and others... as you can see in the image above.

I majorly compare myself with S&P, but since ARKK is a new phenomenon, I do try to perform better than that. This year, I am doing better than both so far. It is a WIN for me as of now.

Portfolio

Portfolio YTD - Thursday - March 25, 2021

With today's gains of over 2%, I am up by 7.39% YTD.

Winners include BNGO, BA, NNDM, a bit of OPEN, and AGTC. The portfolio is divided between multiple sectors. Here is how much of each stock I am invested in.

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| FUBO | Fubotv Inc | 11.00% | 10.39% | -3.58% |

| BA | Boeing Co | 20.00% | 19.84% | 3.32% |

| AAPL | Apple Inc. | 6% | 6.20% | 0.42% |

| MSFT | Microsoft Corporation | 6.00% | 5.60% | -1.33% |

| TSLA | Tesla Inc | 6.00% | 6.17% | 1.61% |

| CRSP | Crispr Therapeutics AG | 11.50% | 11.50% | -0.82% |

| PLTR | Palantir Technologies Inc | 5.44% | 5.44% | 3.20% |

| NNDM | Nano Dimension Ltd. | 3.00% | 2.88% | 6.92% |

| BNGO | BioNano Genomics Inc | 1.00% | 1.22% | 6.33% |

| NIO | Nio Inc | 7.00% | 7.61% | 2.65% |

| STPK | Star Peak Energy | 4.00% | 4.57% | 15.52% |

| CCIV | Applied Genetic Technologies Co | 6.00% | 6.75% | 6.52% |

| OPEN | Opendoor | 5.00% | 4.61% | 2.35% |

| VIEW | View Inc. | 3.00% | 2.38% | -2.62% |

| AGTC | Applied Genetic Technologies Co | 5.00% | 4.73% | 3.94% |

Crytpcurrencies

I manage 2 different portfolios in Cryptocurrencies, just based on exchanges.

I do not trade in HIVE and STEEM, I just have them in my respective platforms as power.

Portfolio 1

With gains of 1491% YTD

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| ADA | Cardano | 35.00% | 34.92% | 4.83% |

| SC | Sia Coin | 25.00% | 24.89% | 11.50% |

| RDD | REDD Coin | 10.00% | 17.15% | -0.24% |

| XVG | Verge | 10.00% | 10.53% | 3.60% |

| XLM | Steller Lumens | 10.00% | 7.42% | 5.16% |

| XRP | Ripple | 10.00% | 5.09% | 12.50% |

Portfolio 2

With gains of 74.31% YTD

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| BAT | Basic Attention Token | 35.00% | 37.39% | 4.67% |

| XLM | Steller Lumens | 30% | 33.53% | 5.42% |

| ADA | Cardano | 15.00% | 16.33% | 5.38% |

| XRP | Ripple | 20.00% | 12.75% | 0% |

Do tell me about your thoughts, let me know where I am wrong, and what you think about my portfolio. I intend to share this regularly just to keep myself in check and to share my performance.