Source

SourceThis is Day 3 of my portfolio sharing with the hive/leo community.

The bloodbath that started last week continues today and it wiped yesterday's gains and then some. I do not sell when the markets are going down, I rather buy more and invest rather than trade.

Buying more of the stocks that are already in loss gives me a better average cost-basis and helps me recover my losses earlier and faster.

Last year I made over 50% gains doing the same thing, and this year until the end of February 2021, I had gained over 30% in YTD. The first target this year is to beat last year's gains and the second target is to catch up with ARKK (which made over 120% last year).

I would like to share my progress and maybe someone finds it helpful or has some suggestions to make.

I manage my stocks in 3 different portfolios,

- Major Portfolio (long-term)

- Small Portfolio (short-term)

- Penny Stocks Portfolio (short-term)

Stocks

Major Portfolio with long-term investment

Performance Comparison

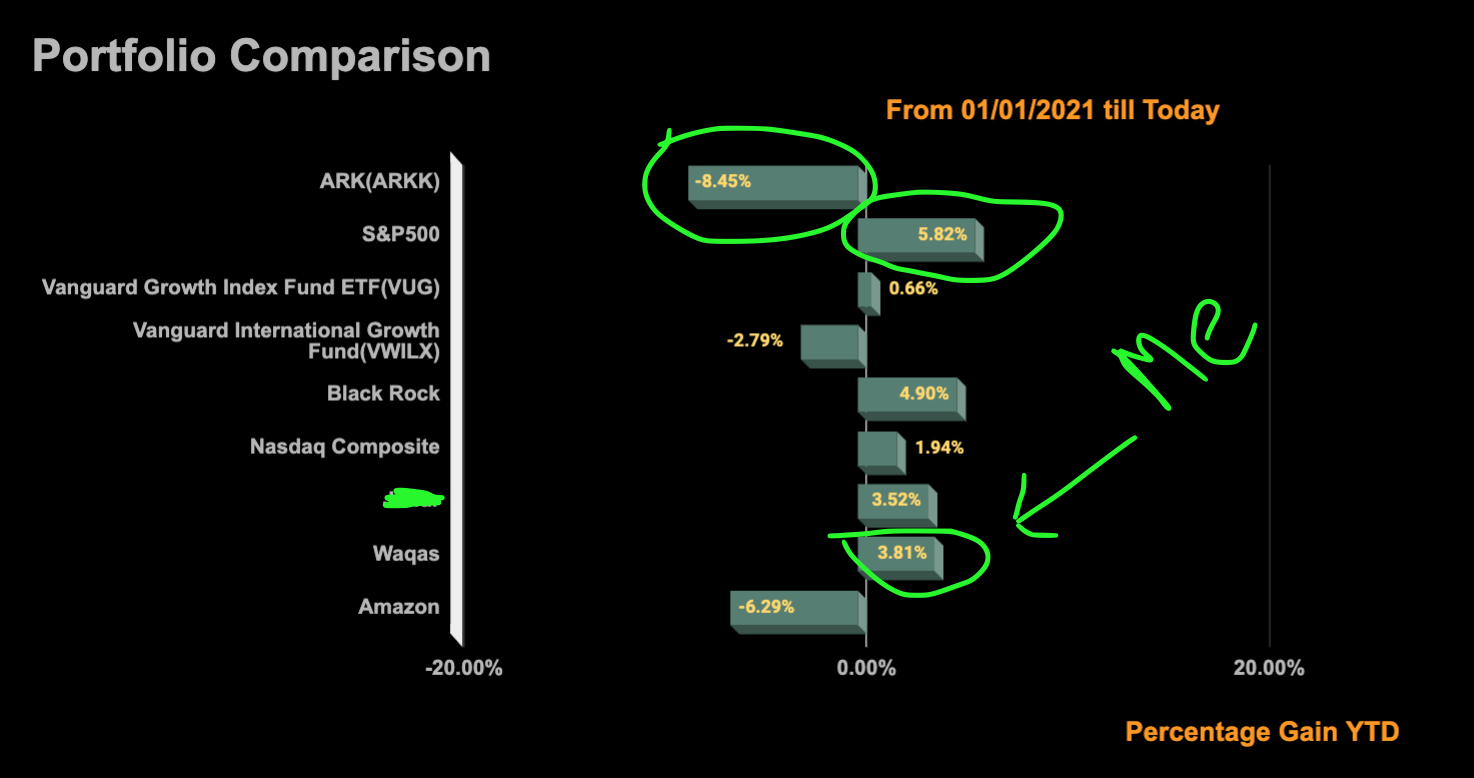

Portfolio Comparison YTD - Friday - March 26, 2021

I have put together a comparison mechanism to check my performance Year-To-Date and I am comparing my performance with following

- ARKK (with over 120% gains last year, this year it is around 8% down)

- S&P (with 15.76% last year, is so far 3.54% up)

- and others... as you can see in the image above.

I majorly compare myself with S&P, but since ARKK is a new phenomenon, I do try to perform better than that. This year, as I mentioned earlier at the beginning of this writeup, I was doing great at 30%, but March dealt a striking blow to all my gains, and my gains have shrunk to a whopping 3.8% so far this year. I am still doing better than the ARKK, but S&P has more gains this year as of today.

Portfolio

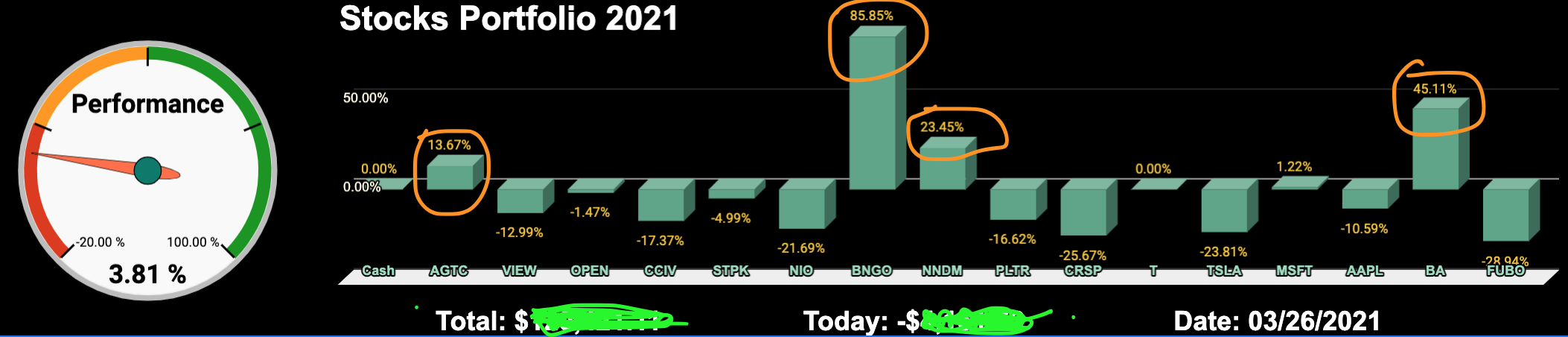

Portfolio YTD - Friday - March 26, 2021

With today's loss of over 3.32%, I am up by 3.81% YTD.

Major Winners include BNGO, BA, NNDM, and AGTC.

The portfolio consists of multiple sectors including Healthcare (growth), Technology (blue chip and growth), Travel & Aerospace, Electronics & Automobile(EV), etc.

Following is the list of holdings and the percentage of my total investment in each.

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| FUBO | Fubotv Inc | 11.00% | 9.08% | -15.49% |

| BA | Boeing Co | 20.00% | 20.33% | -0.94% |

| AAPL | Apple Inc. | 6% | 6.44% | 0.51% |

| MSFT | Microsoft Corporation | 6.00% | 5.89% | 1.78% |

| TSLA | Tesla Inc | 6.00% | 6.17% | -3.39% |

| CRSP | Crispr Therapeutics AG | 12.00% | 11.55% | -2.93% |

| PLTR | Palantir Technologies Inc | 5.00% | 5.63% | 0.04% |

| NNDM | Nano Dimension Ltd. | 3.00% | 2.91% | -2.34% |

| BNGO | BioNano Genomics Inc | 1.00% | 1.29% | -1.90% |

| NIO | Nio Inc | 7.00% | 7.50% | -4.77% |

| STPK | Star Peak Energy | 4.00% | 4.55% | -3.66% |

| CCIV | Applied Genetic Technologies Co | 6.00% | 6.69% | -4.20% |

| OPEN | Opendoor | 5.00% | 4.61% | -4.58% |

| VIEW | View Inc. | 3.00% | 2.60% | 5.66% |

| AGTC | Applied Genetic Technologies Co | 5.00% | 4.73% | -3.42% |

Crytpcurrencies

I manage 2 different portfolios in Cryptocurrencies, just based on exchanges.

I do not trade in HIVE and STEEM, I just have them in my respective platforms as power.

Portfolio 1

With gains of 1620% YTD

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| ADA | Cardano | 35.00% | 34.66% | 9.15% |

| SC | Sia Coin | 25.00% | 24.49% | 13.80% |

| RDD | REDD Coin | 10.00% | 18.26% | 5.05% |

| XVG | Verge | 10.00% | 10.53% | 8.94% |

| XLM | Steller Lumens | 10.00% | 7.05% | 5.65% |

| XRP | Ripple | 10.00% | 4.87% | 7.92% |

Portfolio 2

With gains of 54.55% YTD

| Ticker | Name | Target Investment | Current Investment | Today's Gain |

|---|---|---|---|---|

| BAT | Basic Attention Token | 35.00% | 37.72% | 6.51% |

| XLM | Steller Lumens | 30% | 33.23% | 3.90% |

| ADA | Cardano | 15.00% | 16.86% | 7.82% |

| XRP | Ripple | 20.00% | 12.17% | 7.92% |

Do tell me about your thoughts, let me know where I am wrong, and what you think about my portfolio. I intend to share this regularly just to keep myself in check and to share my performance.

Posted Using LeoFinance Beta