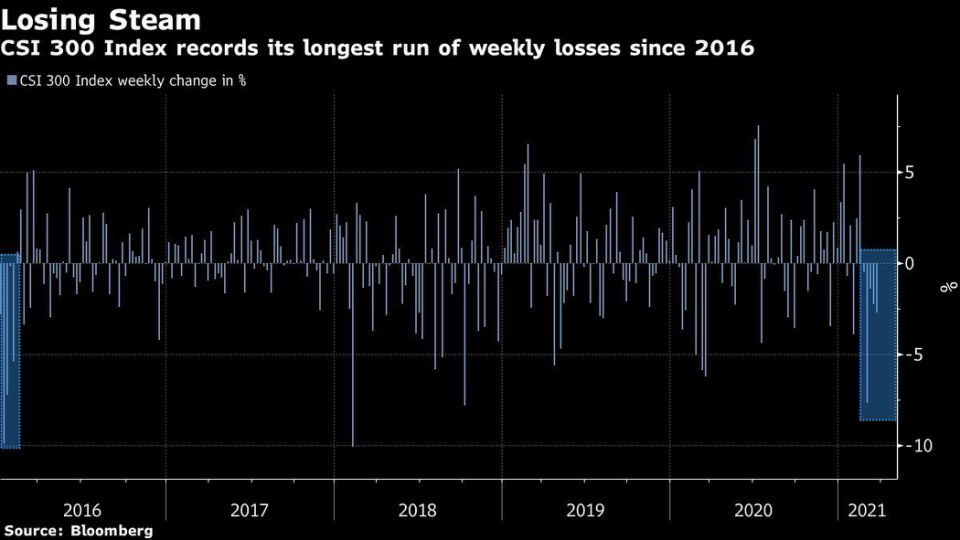

The CSI 300 is a cap-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The CSI 300 has been in a downward trend for over a month and went as much as approximately 16% down. It has been struggling to maintain that has recovered over 1%.

First let's discover why this slid 15% for a month or so?

China has been recently changing its policies and tightening the economy which had been loosened earlier during the Covid-19 pandemic. Loosening in terms of pumping money into the economy to stabilize and maintain it, lower interest rates, etc. It is much like what the USA did with Stimulus. Now that the Chinese economy has recovered post-pandemic and has shown great speedy recovery, it's time to tighten the policies to back where they were. The cost of borrowing is increasing, and Stocks are becoming a great alternative for investment.

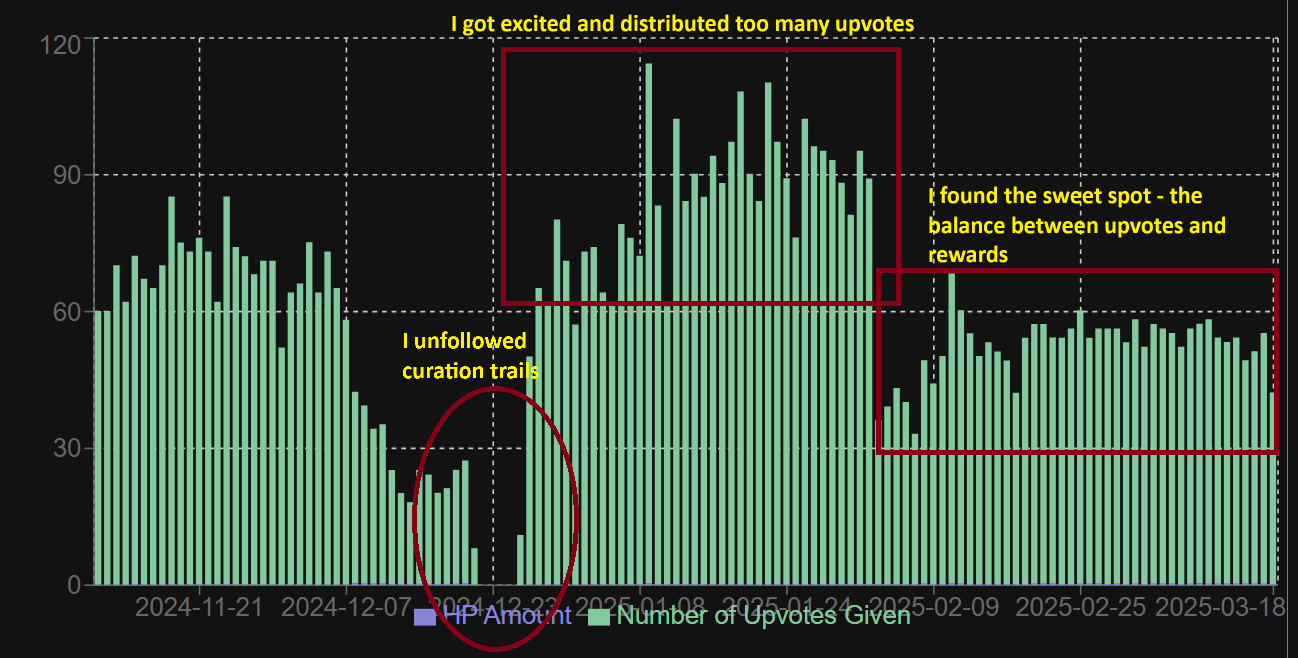

CSI300 Losing Streak since 2016

China has been on a losing streak for the last few weeks, and especially the week of the recent political talks between the Biden Administration and China. 5 weeks in a row, it has maintained its losing streak and this has not happened since 2016, not even during the pandemic in March 2020.

Is it ready for re-bound? When to buy?

If you see the "CSI300 Losing Streak since 2016" chart above, you can easily compare 2016 when CSI was down 5 weeks in a row, the 6th week was great re-bound. We had data here, and we can compare what happens to CSI if it has been beaten for 4 or 5 weeks in a row. I would say, the market is going up short term, and is ready for a rebound this week or the next. Your short-term goals should perfectly align to this.

The 5000 level of CSI300 has been a resistance level in the past, and now it is playing its role as a support level. The MACD momentum also seems to show a reversal of the trend. The RSI has not yet crossed over 50 but it seems like it's ready for a bottom.

So the simple logic here says it's a great opportunity to bet on Chinese ETFs or the stock market as a whole for the short term given all the above indicators and reasons.

Disclaimer: I am not a professional financial advisor and especially not your's financial advisor. Please do your research before investing in anything. Do not invest until you have done your due diligence and know the risks. Invest only what you can afford to lose 100%. This analysis/article is just for FYI purposes.

Please support this write-up to support the economy of Project-Hive. 20% of the earnings will go to Project-Hope for their trouble of promoting and running this great community! Join hands together and let's make this a great economy.